Exporting goods to Japan – Procedures and what to know

Japan is a country with great economic potential and is also one of Vietnam’s greatest export markets. Since then, Vietnam and Japan are members of three bilateral and multilateral free trade agreements (FTAs), including the Vietnam-Japan Economic Partnership Agreement (VJFTA), the Agreement on Trade Agreement The ASEAN-Japan Comprehensive Economic Partnership (AJCEP) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). All of this makes Japan an export destination for Vietnamese businesses.

1. Regulations on exporting goods to Japan

Japan and Vietnam have signed an economic partnership agreement, under which nearly 80% of goods imported from Vietnam will enjoy preferential tax. The Ministry of Industry and Trade has issued form C/O AJ - the type of preferential C/O granted to goods originating in Vietnam exported to Japan together with member countries included in the multilateral trade agreement ACCEP. Therefore, Vietnamese goods have an advantage when exporting to Japan.

2. Customs procedures for exporting goods to Japan

Customs documents for export to Japan usually include:

- Business registration of the exporting enterprise (if exporting for the first time, the next time is not necessary)

- Tax code certificate (if exporting for the first time)

- Commercial contract

- Packing list

- Container handover record

Shipping mark

For export goods, when ensuring convenient transportation and customs clearance, businesses should stick shipping marks on the packages.

Certificate of origin:

When exporting, the Vietnamese government does not require the exporter to make Made in Vietnam origin for exported goods. However, in many cases, the buyer will ask the exporter to make a certificate of origin Made in Vietnam.

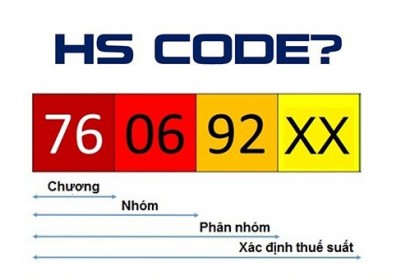

Tax

You first need to determine the HS Code of the goods to be able to look up the exact tax rate. Taxes that may have to be paid when importing goods for business are usually import tax, excise tax, value-added tax (VAT), environmental protection tax, etc.

Commercial invoice when exporting goods to Japan

There must be a minimum of 3 copies of the commercial invoice. Invoices need to be signed by the supplier and include the following details:

- Label number and serial number of the package;

- Description of the goods;

- Insurance and shipping fees;

- Place and time of invoicing;

- Destination and recipient;

- Number of means of transport;

- Import license serial number;

- The conditions of the contract related to the determination of the value of the goods.

Bill of lading

For goods sent by sea, a minimum of 03 signed original bills of lading and 02 copies are required.

For goods sent by air, 01 original bill of lading and 09 copies are required but no strict rules apply. If the actual quantity shipped exceeds the quantity stated in the order, the name and address of the person to be notified should be clearly stated. The information in an importer's trust is usually nominal. Still, it must include the vehicle's name, intermediate and final recipients, the container's label and serial number, and a description of the goods. includes all metric masses and dimensions.

Insurance certificate

A certificate of insurance may be required if a customs inspection paper does not include the required invoice (for tax/quality determination). In such cases, other documents showing the shipping value, insurance premium and price list… may be required.

Goods imported into the Japanese market are controlled by a relatively strict legal system for reasons of protecting national security interests, economic interests or ensuring food safety and hygiene for consumers. consumers. When entering the Japanese market, Vietnamese enterprises need to carefully study and strictly comply with the regulations and laws on Japanese imports.

In SME Logistics, we provide every logistics services you need. Contact us via:

Hotline: 0792871979

Email: head.sales1@smelogistics.vn

Website: https://smelogistics.vn/

VIE

VIE CN

CN