What is HS code? Basic knowledge of HS code in the import/export field

HS code is usually used in import and export. The HS code lookup plays an extremely important role in the calculation of import and export tax and the price of goods. Let's learn more about HS codes to carry out customs procedures accurately and more effectively.

1. What is HS Code?

HS Code is an internationally standardized commodity code analysis, used to determine the import and export tax rates of goods.

HS code is the code number of import and export goods specified under the Goods Classification System issued by the World Customs Organization called "Harmonized Commodity Description and Coding System" (HS - Harmonized System). HS codes make it easier for pressure units to classify goods in the best way.

HS codes are applied according to the HS code of their container.

HS code helps to classify import and export goods optimally thanks to certain systems between countries on customs terminology, helping to provide commercial transaction results.

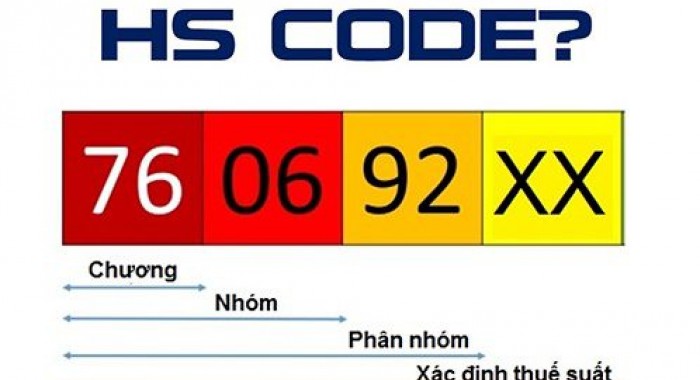

2. HS Code structure

The structure of the HS code includes different parts divided from large to small as Sections, in the section there will be Chapters, in chapters there will be Heading and Subheadings.

The most common way to look up the HS code is to use the tax table (which includes the goods information, the HS code, the normal tax, the preferential tax, the VAT, the tax of each item with the corresponding C/O form. response, protection tax, environmental protection tax, ...)

The layout of the tax table consists of 21 parts, divided into 98 chapters.

21 sections include the following contents:

+ Animals, plants, minerals, plastics, rubber

+ stone products, jewelry, textile products, ...

+ Machinery, electrical equipment, vehicles, tools, ...

Chapters in the right to import tariffs include:

+ The first 97 chapters classify general goods

+ Chapters 98 and 99 are the chapters that classify preferential goods by country and region.

Thus, businesses should know the first 97 chapters of the tax table and only tangible goods are identified in the tax schedule.

Currently, Vietnam applies HS codes with 8-digit goods, in some countries around the world can use HS codes with 10 or 12 numbers.

3. How to check HS code

- Look up online via website: You can look up the HS code online at bieuthue.net or Customs.gov.vn.

- Look up based on the import and export tariff of goods: through the tax form file, you can use the input of keywords about related goods, search and look up the appropriate HS code according to the description and category. sectors.

Besides knowing how to look up the HS code, you also need to know the 6 rules of looking up the HS code to know if the information you find is correct or not.

Rule 1: Chapter Notes & Identifiers

Rule 2: Unfinished Products & Compounds of the Same Group

Rule 3: Goods are at first glance in many groups

Rule 4: Sort by the goods that are most like them

Rule 5: Containers, packaging

Rule 6: Explain how to properly classify and compare.

Above are the things you need to know about HS code used in import and export. For more information and consultation, please contact us via

Email: head.sales1@smelogistics.vn

Website: https://smelogistics.vn/

VIE

VIE CN

CN